I thought perhaps I might sell my home, and so, I decided to do a little research on when historically the best time might be vs. the best historical sales price that might be obtainable.

From the R100 Market Facts page at the Real Estate Institute of New Zealand web site: http://www.reinz.org.nz/reportingapp/default.aspx?RFOPTION=Report&RFCODE=R100

I downloaded all data, from all dwellings, between the dates of January 1992 to October 2009. I selected the medians calculated over a one month period dropdown box.

I took all the data and then loaded it into my own database. Doing this allows me to place the data into a more readable format so I could conduct my research.

First, I decided to base my study on the Actual Number of Homes that are sold each month. This, I felt is a better indicator of market trend because it does in fact provide the actual number of houses sold in a particular time period (in this case per month); and while the REINZ web site does not provide the actual number of houses on the market at any given time (those not sold) I felt that the number of houses actually sold would be more reflective of market mood and market activity than any other indicator.

Because the year 2009 is not yet complete I decided not to use any data from 2009 and instead used all the data from 1992 to 2008 – a seventeen year period.

Looking at the numbers without a database to manipulate their format is a fruitless task. However, database in hand I went to work.

Out of 204 rows of data, representing 204 months over the seventeen year period, I noticed that actual homes sales of more than 7,000 homes in one month occurred 99 times leaving 105 pieces of data that were below this mark. 7,000, as it turned out, is not only a good halfway mark but is very close to the average of 7139.4 and the median of 6910.5 of all the data (not including 2009).

By reformatting the dates I was able group the data by year and month.

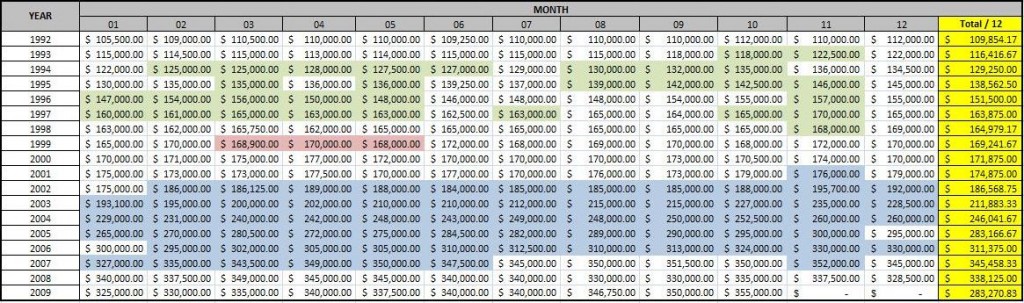

Chart 1, Number of actual home sales

Notice: that even though the chart shows the data for 2009 keep in mind I have not utilized it for my calculations. This is true for all charts – 2009 data is not used.

Take a look at Chart 1 carefully. Notice that I have highlighted all numbers greater than 7,000. The time period between 2002 and 2007 do appear to coincide with the housing bubble. And therefore, I conclude, that earlier, during the period between 1994 and 1997 and then for a short period in 1999 that the number of house sales above 7,000 do indicate that a higher than normal activity occurred, possibly smaller “bubbles.”

In the two following charts, Chart 2 and Chart 3 I highlighted the exact same boxes to see what that data might reveal.

Chart 2, Median Sales Price

Chart 2 contains the Median Sales Price collected during the time period. And Chart 3 shows the Median number of days homes remained on the market before being sold.

Chart 3, Median time on market

As you can see differentiating some data from other data is a complex task. What can we learn from these three charts? While beyond the scope of this piece all I can say is that at a glance, the closely spaced data indicates a relatively flat, but steady market place growth. Chart 1 demonstrates the outliers with house sales surging above 10,000. Chart 2 demonstrates an ever increasing Median Sale Price. Chart 3 indicates that the Median time to sell your house can vary between 30 and 60 days (approx.). All pretty humdrum ordinary stuff, and while REINZ does not provide the numbers of all homes on the market I do believe that I was correct in using the actual home sales as a basis for my conclusion that home sales above 7,000 do indicate an upward trend in activity. As for the three charts above, feel free to make your own conclusions as to the true meaning of the numbers contained therein. But for me, my original quest was to find the best time to put my house on the market and receive the best possible price during that time period.

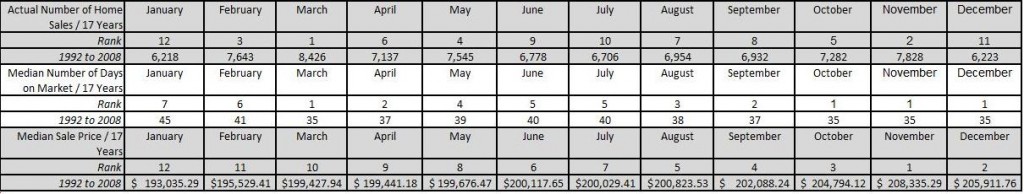

Using the charts above I made two more charts (see below). These charts, Chart 4 and Chart 5, contain the exact same numbers but I used different layouts to get a better handle on those numbers.

Chart 4, the data is ranked

Chart 5, same ranked data, but different format

I simply totaled my three original charts by month and then ranked my results, 1 being the best. Remember these totals represent a seventeen year period, 1992 to 2008, and so regardless of “bubbles,” this particular grouping of the data should give me the answers that I am looking for.

First, let’s look at a few things. More homes are sold in March than any other month. Also, I can expect the shortest time on the market with a median of 35 days but unfortunately I can also expect one of the worst sales prices for my home with a ranking of 10. The highest rank for the median home sale is the month of November, which happily coincides with the highest ranking for the median number of days on the market and the number 2 ranking for number of houses sold during the month – almost the best of all three worlds!

These last two charts demonstrate that it is supremely wicked to look at data on a short term basis as this recent NZ Herald article does.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10609061

Basically, this article looks at 2009 vs. 2008 values and focuses on the October 2009 values. The article essentially touts a resurgence in the housing industry. But yet, note how, based on Chart 4 and 5 that this feel-good newspaper article coincides with history. In other words — this was to be expected; seventeen years of historical data cannot be wrong! Just look at the ranking for October, 5, 1 and 3 respectively. What can we expect when REINZ provides us with the November 2009 data? Well, the above chart tells me that with a ranking of, 2, 1, and 1 that November will be an even better performing month than October. December won’t be as good, and January 2010 will be the worst — but then, from there, it’s all uphill. July 2010 will suck – but hey it’s July – what can you expect?

As with the first three charts, I’ll allow you to make your own deeper interpretations of market trend and market history. But, for me, I have found what I was looking for.

To sell my house, then the best time is probably November — it has the best price, the shortest market time, and the flurry of the second highest market activity. But, I must always consider, that if I’m willing to sacrifice price, then some months are worse than others, March should provide the fastest sell time; January the longest.

Now one final question remains. Selling my home implies that I will need to buy another home to live in. So what do my charts tell me? Well, it looks like the best time would be when the sellers are most stressed and clearly that time is January. One thing to keep in mind is that median numbers were used in “The days on market” column and so, one should consider that 35 days as a median equates to 70 days (not exactly, but good enough for this discussion) in planning. A good rule of thumb would be to expect at least 3 months on the market regardless of market trends. Listing my house in late August should put me on target to sell in November and then buy in January. I hope so. But, then as a wise man once said, “…But then this is real estate investing – anything can happen – and probably will!” http://www.propertytalk.com/forum/showthread.php?t=21942

NOTE: To get a clearer look at the the charts, right-click the image and save it to your hard drive. [Or right click and view image in another tab? – ed]

Understatement of the week!

Thanks Chowbok. November, huh?

This exercise reminds me of a little book I have somewhere: “Don’t sell stocks on Monday” which (among other things) showed (with graphs & tables to prove it) Mondays were generally a bad day to get a good price for shares. I think the ‘explanation’ was that the punters digested bad news over the weekend and ‘dumped’ stocks reactively on Mondays.

A nice line attributed to Yogi Berra …

“In theory there is no difference between theory and practice. In practice there is.”

I read somewhere that you are more likely to be pulled over by the Traffic Police while driving in the passing lane. Therefore, the longer you spend in the passing lane the higher your chance of being pulled over becomes. But, it makes sense when you think about it.

There is a great book by Malcom Gladwell called “Outliers.” It’s a terrific read and goes into depth on “seemingly unrelated and mysterious social patterns.” As it turns out things are not so mysterious after all. Excellent book!

And yet, the discredited ‘the market knows best’ idea will, I believe, persist.

I enjoy ‘working out’ why people do things, in the meteorological sense (i.e. a complicated model giving only hints of the relationships and variables and, of necessity, tolerant of inexactitude).

As mentioned earlier Vance Packard’s The HIdden Persuaders opened my eyes to how very trivial inputs can lead people to reach significant wide-reading conclusions which affect their actions … without understanding the triggers.

Bob Dylan says in his Chronicles volume 1 that he stopped reading psychology when a friend pointed out that the top people/high priests of psychology were all in marketing and advertising.

I still find it (and M Gladwell et al) very interesting. – P